Banking Assignment in Tally

Banking Assignment in Tally

1. Introduction

Read the

below-given business scenario and implement it in Tally Prime by creating a

company for Raj Enterprises.

1.1.

COMPANY DETAILS

Company

Name – Raj Enterprises – Financial Year 01-04-2019 to 31-03-2020

|

Bank

Details |

|

|

Name |

HDFC Bank |

|

A/c No |

017520212334 |

|

IFS Code |

HDFC0000017 |

|

Opening Balance |

50,000 Dr |

|

Cheque Book Details |

Book with 100 Cheque leaves and the

starting number is "009601" |

1.2.

Banking transactions

Record

below banking transactions in Raj Enterprises books

|

02-04-2019 |

A cheque amounting to Rs. 20,000 was

printed and paid to the supplier Anu Traders via Cheque No. 009601 |

|

05-04-2019 |

Received cash from the customer Music

Shop Rs. 3,500 and the same deposited into the bank |

|

07-04-2019 |

Purchased a printer for office use

for Rs. 15,000 from Metro Shoppe and cheque paid against the

purchases; Cheque No 009602 |

|

10-04-2019 |

Withdrawn Cash from bank Rs.2,000 for

the petty expenses; Cheque No 009603 |

|

15-04-2019 |

Rent paid for the Office by cheque

Rs. 5,000; Cheque No 009604 |

|

22-04-2019 |

Post-dated Cheque Received for Rs. 20,000

from Music Shop (Cheque No. 098766, PDC date: 10-05-2019, Bank: State bank of

India) |

|

27-04-2019 |

Cheque received from customer Savita

Traders Rs. 10,000 (Cheque No. 023766, Bank: State Bank of India) |

|

29-04-2019 |

Cheque numbers 009605 to 009616

issued to Magnum Honda as blank cheques from 5th of every month for 12 months.

|

1.3.

bank statement – excel format (for auto bank reconciliation)

Raj

Traders has downloaded below bank statement in excel format from your net

banking, do Auto Bank Reconciliation in Tally using this excel statement:

1.4.

bank statement – hard copy (for manual bank reconciliation)

You

have received the below bank statement from your bank, complete Bank

Reconciliation with your Bank book:

|

Date |

Description |

Ref.\Cheque |

Debit |

Credit |

Balance |

|

Opening |

50000 |

||||

|

05-Apr |

Deposit |

3500 |

53500 |

||

|

08-Apr |

Payment to Anu Traders |

9601 |

20000 |

33500 |

|

|

10-Apr |

Withdrew |

9603 |

2000 |

31500 |

|

|

20-Apr |

Payment to Krishna |

9604 |

5000 |

26500 |

|

|

27-Apr |

Deposit by Savita Traders |

10000 |

36500 |

||

|

28-Apr |

Payment to Metro Shoppe |

9602 |

15000 |

21500 |

|

|

28-Apr |

Bank Charges |

260 |

21240 |

||

|

30-Apr |

Deposit by Johnson Trader |

5400 |

26640 |

2. Reports outcome

2.1.

Auto Bank Reconciliation Report after importing Excel Statement

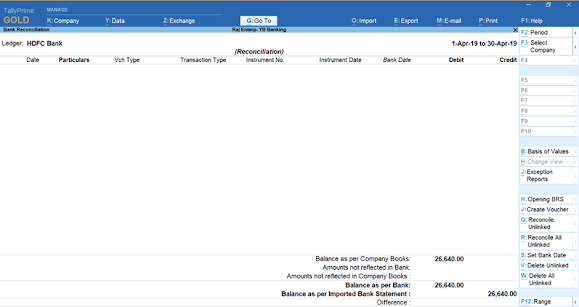

2.2.

Bank Reconciliation Report after completing reconciliation

2.3.

Bank ledger report

2.4.

Post Dated Transactions Report

2.5.

Cheque Register – Book 1

Reviewed by ADcomputercampus

on

August 25, 2024

Rating:

Reviewed by ADcomputercampus

on

August 25, 2024

Rating:

No comments: