GST Composite and Mixed Supply Practical Assignment in Tally

GST Composite and Mixed Supply Practical Assignment in Tally

George

Distributors Pvt Ltd is distributing various brands of packed wheat flour and detergent

soaps. As it is supplying in bulk, it is

charging its customers with Packing and Delivery Charges. Set-up Tally to calculate GST appropriately

on Stock Item and Packing & Delivery Charges as per the GST Act.

Sales

with 5% GST – State GST 2.5% and Central GST 2.5%

·

On 1st

April 2019, sold 500 Packets of ‘Wheat Flour 5 Kgs’ at 180 / packet and Packing

Charge is 1,000 and Delivery Charges is 2,000 to Jayanti Supermarkets Ltd

Sales

with 18% GST – State GST 9% and Central GST 9%

·

On 5th

April 2019, sold 1,000 Nos of ‘Detergent Bar 300 Gms at 40 / Nos and Charge is

500 and Delivery Charges is 1,000 to Noble Traders Ltd

Sales

with a combination of 5% and 18% GST

·

On 10th

April 2019, sold 1,000 Nos of ‘Detergent Bar 300 Gms at 40 / Nos and 500

Packets of ‘Wheat Flour 5 Kgs’ at 180 / packet Packing Charge is 3,000 and

Delivery Charges is 5,000 to Noble Traders Ltd

Check

how GST on Packing and Delivery charges affected with a selection of stock item

having different GST rate.

Manjunath

Food Products Ltd packs multiple nuts and dry fruits into 250gms and 500gms

packets and sells to its customers. Each

nut is attracting different GST Rates.

Set-up

Tally as per GST Act so that multiple GST rate goods are packed and then sold

to customers

·

On 1st

Apr 2019, the company purchased below materials from ‘Spectrum Food Products’

|

Stock

Item Name |

Qty |

Rate |

GST

Rate |

|

Almonds |

200

kgs |

750 |

6% |

|

Cashew

Nuts |

500

kgs |

900 |

5% |

|

Raisins |

200

kgs |

190 |

5% |

·

On 5th

April 2019, the company manufactured 2,000 packets of ‘Mixed Nuts 250 gms’

having below items

|

Bill

of Material (BOM) |

Qty |

|

Almonds |

50

gms |

|

Cashew

Nuts |

150

gms |

|

Raisins |

50

gms |

·

On 10th

April 2019, the company sold 500 packets of ‘Mixed Nuts 250 gms’ at 225/pkt

plus GST to Mahaveer Stores

1.2.

business scenario iii

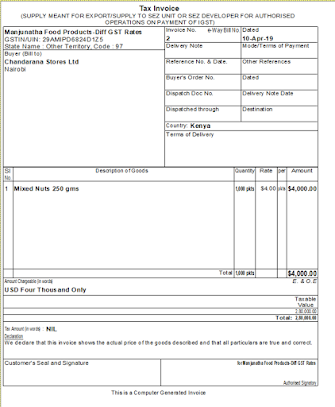

Manjunath

Food Products Ltd exports goods to other countries, set up Tally and do export

sales for GST.

·

On 20th

April, the company exported 1,000 packets of ‘Mixed Nuts 250 gms’ for $ 4 @

70/$ to Chandarana Stores Ltd, Nairobi, Kenya

1.3.

business scenario iv

Manjunath

Food Products Ltd deals in fresh Areca Nuts which are not dried of peeled, it

is ‘Zero Rated’ GST bracket. Set-up

Tally to prepare invoices with ‘Bill of Supply’ title.

· On 21st April 2019, company sold 1,00 kgs of Fresh Areca Nuts at 500/kg to Seetha Groups

Below are

the outcomes after setting up batches, mfg date and expiry dates as per

business scenarios, this is for your reference to ensure that you have done it

properly.

2.1. business scenario i

Packing and Delivery Charges with 5% GST Rate

Tax Analysis for 5% GST Rate

Reviewed by ADcomputercampus

on

August 16, 2024

Rating:

Reviewed by ADcomputercampus

on

August 16, 2024

Rating:

No comments: