Budget Practical Assignment in Tally

Budget Practical Assignment in Tally

Read the

below-given business scenario and implement it in Tally Prime by creating a

company for Raman

Research Centre.

1.1.

Business Scenario I

Raman Research

Centre is a research company owned by Mr. Raman. He wants to plan and track the

expenses

|

Expenses Name |

Period |

Budgeted Amount |

Budget Type |

|

Advertisement Expenses |

Q1 - AMJ |

1,00,000 |

On Closing Balances |

|

Sales Bonus |

Q1 - AMJ |

1,00,000 |

One Net. Transactions |

Record the below

transactions

|

Date |

Transaction details |

Amount |

|

01-04-2019 |

Payment made for

Advertisement Expenses |

20,000 |

|

30-04-2019 |

Payment made for

Sales Bonus |

30,000 |

|

05-05-2019 |

Payment made for

Advertisement Expenses |

25,000 |

|

30-05-2019 |

Payment made for

Sales Bonus |

30,000 |

|

25-06-2019 |

Payment made for

Advertisement Expenses |

20,000 |

|

30-06-2019 |

Payment made for

Sales Bonus |

50,000 |

1.1.

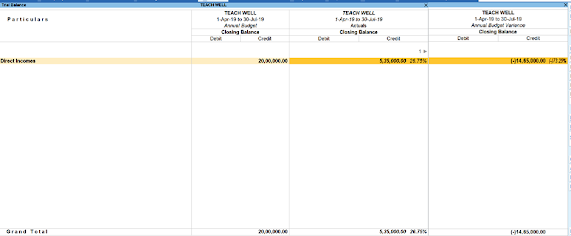

Business Scenario II

Teach Well Ltd is

willing to track Indirect Expenses and Direct Incomes for the whole year and

compare with budgeted amounts.

|

Group Name |

Period |

Budgeted Amount |

Budget Type |

|

Indirect Expenses |

FY – 2019-20 |

10,00,000 |

On Closing Balances |

|

Direct Income |

FY – 2019-20 |

20,00,000 |

On Closing Balances |

Record the below

transactions

|

Date |

Transaction details |

Amount |

|

20-04-2019 |

Tuition Fees

received |

75,000 |

|

30-04-2019 |

Salaries paid |

50,000 |

|

05-05-2019 |

Tuition Fees

received |

1,25,000 |

|

30-05-2019 |

Salaries paid |

60,000 |

|

30-05-3019 |

Advertisement

expenses paid |

40,000 |

|

25-06-2019 |

Tuition Fees

received |

1,45,000 |

|

30-06-2019 |

Salaries paid |

75,000 |

|

30-06-2019 |

Commission paid |

30,000 |

|

20-07-2019 |

Tuition Fees

received |

1,90,000 |

|

30-07-2019 |

Salaries paid |

70,000 |

|

31-07-2019 |

Office Rent paid |

40,000 |

1.1.

Business Scenario III

Ideal Paints Ltd

is having salesmen and fixes targets for their performance, every half year it

does performance review against targets.

|

Salesman Name |

Period |

Budgeted Amount |

Budget Type |

|

Anil Sharma |

HY – Apr 19 to Sep 20 |

8,00,000 |

On Closing Balances |

|

Srinivasan |

HY – Apr 19 to Sep 20 |

10,00,000 |

On Closing Balances |

Record the below

transactions

|

Date |

Transaction details |

Amount |

Salesman |

|

18-04-2019 |

Sales |

88,000 |

Srinivasan |

|

25-04-2019 |

Sales |

72,500 |

Anil Sharma |

|

04-05-2019 |

Sales |

44,500 |

Anil Sharma |

|

25-05-2019 |

Sales |

98,000 |

Srinivasan |

|

28-05-3019 |

Sales |

23,300 |

Srinivasan |

|

20-06-2019 |

Sales |

55,500 |

Anil Sharma |

|

22-06-2019 |

Sales |

35,550 |

Srinivasan |

|

28-06-2019 |

Sales |

49,990 |

Anil Sharma |

|

15-07-2019 |

Sales |

74,440 |

Srinivasan |

|

30-09-2019 |

Sales |

88,880 |

Anil Sharma |

|

30-09-2019 |

Sales |

44,440 |

Srinivasan |

1.1.

Budget tracking

Below are

the outcomes after recording transactions in business scenarios, this is for

your reference to ensure you have done it properly.

1.1.

Budget Variance Report – Business Scenario I

1.1.

Budget Variance Report – Business Scenario II

Reviewed by ADcomputercampus

on

August 13, 2024

Rating:

Reviewed by ADcomputercampus

on

August 13, 2024

Rating:

No comments: