GST in Tally Prime

GST

(Goods and Service Tax)

GST is an Indirect Tax which has replaced many Indirect Taxes in India. The Goods and Service Tax Act was passed in the Parliament on 29th March 2017. The Act came into effect on 1st July 2017.

In simple words, Goods and Service Tax (GST) is an indirect

tax levied on the supply of goods and services. This law has replaced many

indirect tax laws that previously existed in India.

GST is one

indirect tax for the entire country.

Old Tax Method

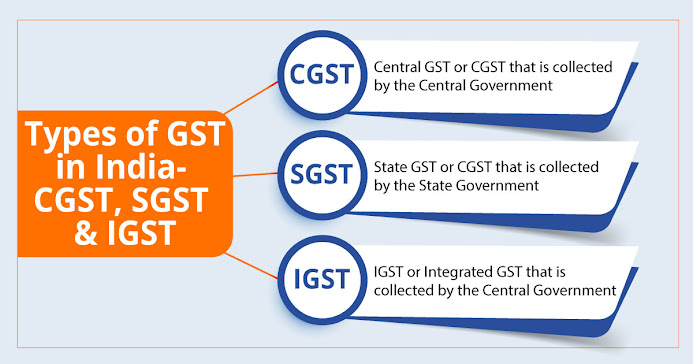

Components of GST-

There are 5 taxes applicable

under this system-

CGST:

Collected by the Central

Government on an intra-state sale (Eg: transaction happening within

Maharashtra)

SGST:

Collected by the

State Government on an intra-state sale (Eg: transaction happening within

Maharashtra)

IGST:

Collected by the

Central Government for inter-state sale (Eg: Maharashtra to Tamil Nadu)

UTGST:

Union Territory Goods

& Services Tax – Applicable if you are in union territory in replacement

with SGST.

Cess :

Applicable on

certain items in addition to the above GST.

Collect GST Taxes:

Define GST Taxes:

Intra state-:

1) State to State Sale/ Purchase 👉 CGST & SGST (Both)

Ex-Up to Up Sale/Purchase

Inter State-:

2) State to other State (Not Local) Sale/Purchase 👉 IGST (Only)

Ex-Up to Gujrat Sale/Purchase

GST Tax Rate

There are five slabs fixed for GST Rates - 0%, 5%, 12%, 18%

and 28%

Common Nil Rated or 0% GST Products:

Milk, eggs, curd, buttermilk, Fresh vegetables

and fruits, Un-branded wheat and rice, un-branded flour, Puja Items

Items under GST 5%

Frozen Vegetables and fruits, branded wheat

and rice, branded flour, hand-made safety matches, cotton, cotton fabrics,

Footwear below Rs.500 etc.

Items under GST 12%

Butter, Cheese, Dry fruits, mobile phones,

ayurvedic products etc.

Items under GST 18%

Biddi wrapper leaves, biscuits, footwear

exceeding Rs. 500, man-made fibre, hair oil, soap, toothpaste etc.

Items under GST 28%

Biris, LED TV, AC, Cars, tobacco products,

cement etc.

GSTIN (GST Identification Number)

GSTIN, or Goods and Services Tax

Identification Number, is a 15-digit alpha-numeric code that your firm gets

after being registered under the GST regimen of India. If the annual turnover

of your business exceeds the threshold limit or the firm does inter-state

business, you should mandatorily apply for the firm’s GSTIN.

Structure of GSTIN

GSTIN number is a 15-digit code representing

several particulars about the business, including its PAN number, state of

business, etc. Following is the breakdown of the GSTIN structure:

1) First two digits indicate the state where the

business is located.

2) Following ten digits are the PAN number of the

business or its owner.

3) Next digit is the entity number under the same

PAN number.

4) The 14th number is ‘Z’ by default.

5) The last number is a check code that helps in

detecting errors.

HSN/SAC Code

HSN/SAC Code HSN (Harmonized System of

Nomenclature) is developed by the World Customs Organization (WCO). These codes

are used to classify the goods and are accepted across the world. HSN codes help

in filling the GST returns, import and export of goods.

They are similar in the countries that are

under the WCO. 6-digit HSN codes are typically used for the goods. However,

some countries use 8-digit codes to sub classify goods.

Mobile Telephone HSN Code :851712

GST

👇

F11 Feature

👇

Enable and Goods and services Tax (GST) ?

YES

Default Ledger

1)

Reviewed by ADcomputercampus

on

April 03, 2023

Rating:

Reviewed by ADcomputercampus

on

April 03, 2023

Rating:

No comments: